Introduction to Inverted Head and Shoulders

The Inverted Head and Shoulders pattern is a pivotal concept in technical analysis, marking a potential reversal from a bearish to a bullish market trend. This pattern is distinguished by its unique structure, consisting of three key troughs, with the central trough (the head) being the deepest, flanked by two shallower troughs (the shoulders). The pattern emerges during a downtrend, symbolizing the exhaustion of the bearish momentum and the onset of bullish forces.

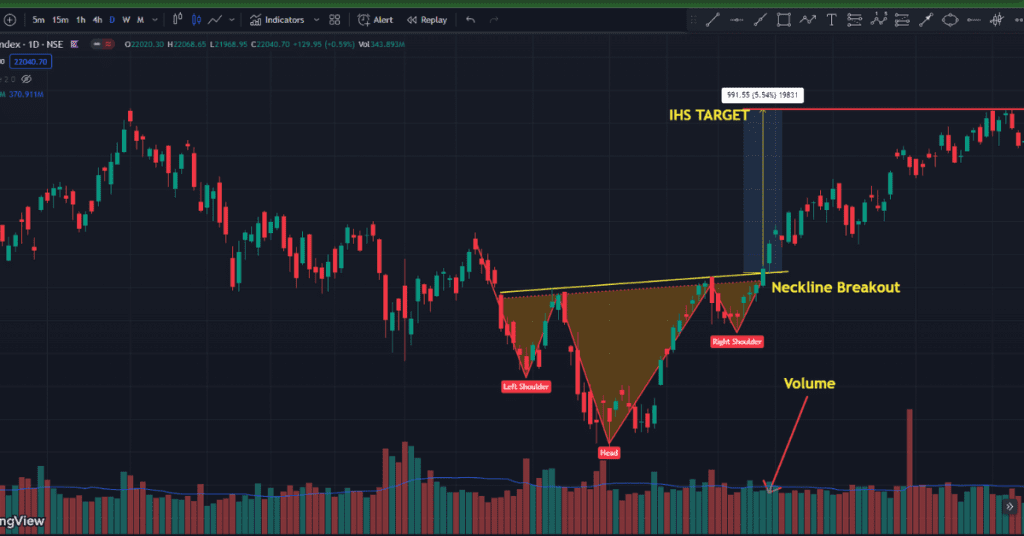

At the heart of this pattern is the “neckline,” a resistance level formed by connecting the highs of the two troughs that constitute the shoulders. A decisive breakout above this neckline confirms the pattern, signaling a shift in market dynamics where buyers start to outweigh sellers, setting the stage for a potential upward trend in the asset’s price.

The Inverted Head and Shoulders pattern is highly regarded among traders and investors for its reliability in forecasting bullish reversals. Its formation reflects not just market price movements but also underlying investor psychology, showcasing a gradual transition from pessimism to optimism. As such, it serves as a critical tool in the arsenal of those looking to capitalize on shifts in market trends, offering insights into potential entry and exit points for trades. Understanding and accurately identifying this pattern can significantly enhance decision-making in trading and investment strategies, making it a fundamental concept for those engaged in market analysis.

Anatomy of the Pattern

The anatomy of the Inverted Head and Shoulders pattern is pivotal for understanding its bullish reversal signal in technical analysis. This pattern is comprised of several key components, each playing a crucial role in its formation and interpretation:

- Left Shoulder: The formation begins with the left shoulder, which is created following a decline in the asset’s price. This is followed by a subsequent rise, setting the initial trough and peak that begins to outline the reversal pattern.

- Head: After the formation of the left shoulder, the price experiences a more significant drop, forming the lowest point of the pattern, known as the head. This trough is deeper than the left shoulder, indicating a potential exhaustion of the downward momentum.

- Right Shoulder: Following the head, there is a rise in the price, similar to the recovery after the left shoulder, but it fails to reach the previous high, forming the right shoulder. The trough of the right shoulder is higher than the head, signaling weakening bearish sentiment.

- Neckline: A key feature of this pattern is the neckline, drawn by connecting the high points of the two troughs forming the shoulders. The neckline can be horizontal or sloping and represents a resistance level. A decisive breakout above this neckline is necessary to confirm the reversal pattern.

- Volume: Volume plays a significant role in confirming the validity of the pattern. Ideally, volume should be higher on the declines that form the head and lower on the formation of the right shoulder. An increase in volume during the breakout above the neckline further validates the pattern’s bullish signal.

Understanding the anatomy of the Inverted Head and Shoulders pattern is crucial for traders and analysts. It not only helps in identifying potential bullish reversals but also in making informed decisions regarding entry and exit points in trading strategies. The pattern’s components, especially the neckline breakout and volume confirmation, are key indicators of a shift from bearish to bullish market sentiment.

फ्री में डीमेट अकाउंट (Demat Account) ओपन करने के लिए यहाँ क्लिक करे

Identification Guidelines

Identifying the Inverted Head and Shoulders pattern correctly is crucial for leveraging its potential as a bullish reversal signal in technical analysis. Here are the key guidelines to ensure accurate identification:

- Prior Trend: The pattern must emerge during a prevailing downtrend. Its significance as a reversal pattern is only valid if it follows an established bearish trend, indicating a potential shift in market sentiment.

- Troughs and Peaks:

- Left Shoulder: Begins with a trough followed by a rise, setting the initial stage for the pattern.

- Head: A subsequent, more significant drop forms the lowest point (head), followed by a recovery that fails to surpass the left shoulder’s peak.

- Right Shoulder: A less pronounced drop forms the right shoulder, which is higher than the head, indicating diminishing selling pressure.

- Neckline: This is a critical component formed by drawing a line connecting the peaks of the two shoulders. The neckline can be horizontal or slightly sloping and acts as a resistance level. A breakout above the neckline is essential for pattern confirmation.

- Volume Confirmation: Ideal volume patterns include higher volume during the head’s formation and decreasing volume at the formation of the right shoulder. An increase in volume during the neckline breakout strengthens the signal.

- Symmetry: While perfect symmetry is not required, the shoulders should be comparably shallow, and the head should be noticeably lower, indicating a significant trough. The pattern should resemble a basin shape, reflecting a gradual shift in sentiment.

- Breakout and Confirmation: The pattern is confirmed when the price breaks above the neckline with sufficient volume. Some traders look for a retest of the neckline from above as further confirmation of the bullish reversal.

- Duration: The formation of the pattern can vary from several weeks to many months. A longer formation period can indicate a more significant potential reversal.

By adhering to these guidelines, traders and analysts can more accurately identify the Inverted Head and Shoulders pattern, enhancing their trading strategies with a reliable signal for a potential bullish market reversal.

Trading Strategies

When trading based on the Inverted Head and Shoulders pattern, several strategies can be employed to capitalize on the potential bullish reversal. Here are key trading strategies associated with this pattern:

- Entry Point:

- Consider entering a long position once the price breaks above the neckline with convincing volume. This breakout is viewed as confirmation of the pattern and the potential start of a new bullish trend.

- Some traders wait for a pullback to the neckline after the breakout as a more conservative entry point, ensuring the pattern’s validity.

- Stop Loss:

- To manage risk, place a stop loss just below the lowest point of the right shoulder or the head. This minimizes potential losses if the breakout fails and the price reverses back into the downtrend.

- Adjust the stop loss according to the asset’s volatility and your risk tolerance.

- Profit Targets:

- The minimum profit target can be projected by measuring the vertical distance from the head’s lowest point to the neckline and extending it upward from the breakout point.

- Some traders use Fibonacci levels or other resistance levels identified on the chart to set multiple profit targets.

- Volume Confirmation:

- Pay close attention to volume as it plays a crucial role in confirming the pattern. An ideal scenario is an increase in volume on the breakout above the neckline, indicating strong buying interest.

- Confirmation with Other Indicators:

- To increase the reliability of the pattern, use additional technical indicators such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) for confirmation.

- Look for convergence with other signals to confirm the bullish sentiment, such as a crossover in moving averages or an RSI moving above 50.

- Risk Management:

- Always be aware of the potential for false breakouts. Implement strict risk management practices, including setting stop losses and only allocating a portion of your portfolio to any single trade.

By incorporating these strategies, traders can effectively utilize the Inverted Head and Shoulders pattern to make informed decisions in their trading endeavors, enhancing the potential for profit while managing risk.

फ्री में डीमेट अकाउंट (Demat Account) ओपन करने के लिए यहाँ क्लिक करे

Psychological Interpretation

The Inverted Head and Shoulders pattern is not only a technical formation but also a representation of market psychology, reflecting a shift from bearish to bullish sentiment among investors and traders. Here’s the psychological interpretation behind the pattern:

- Formation of the Left Shoulder: Initially, after a period of declining prices, the market attempts a recovery, forming the left shoulder. This is a period where some traders start to see value, initiating a brief buying phase. However, the prevailing bearish sentiment is still strong, causing the price to fall again.

- Creation of the Head: The drop that forms the head represents a climax of bearish sentiment, where the market pushes the price to a new low. This might be triggered by lingering negative news or market conditions. However, this low is not sustained for long, as it attracts more buyers seeing even greater value, leading to a stronger recovery.

- Formation of the Right Shoulder: As the price rises again but fails to reach the previous high (left shoulder), it starts to fall, forming the right shoulder. This is a critical juncture where the market is testing the bearish sentiment once more. The failure to reach a new low indicates that selling pressure is waning and the bearish momentum is losing its grip.

- Breakout Above the Neckline: The decisive breakout above the neckline represents a significant shift in market sentiment. It is at this point that the market collectively acknowledges the diminishing bearish pressure and starts to anticipate a bullish phase. This breakout is often accompanied by increased volume, a sign of strong buying interest and confidence in the market’s new direction.

- Reversal to Bullish Trend: The completion of the Inverted Head and Shoulders pattern and the subsequent movement above the neckline reflect a complete turnaround in market psychology. The pattern tells the story of a market transitioning from pessimism and selling pressure to optimism and buying interest, setting the stage for a new bullish trend.

In essence, the Inverted Head and Shoulders pattern encapsulates a narrative of struggle between bears and bulls, with the eventual breakout symbolizing the triumph of bullish sentiment. Understanding this psychological aspect can provide traders and investors with deeper insights into market dynamics, enabling more informed decision-making.

Limitations and Considerations

While the Inverted Head and Shoulders pattern is a valuable tool in technical analysis for signaling potential bullish reversals, it comes with limitations and considerations that traders should be aware of:

- False Signals: Not every Inverted Head and Shoulders pattern leads to a bullish reversal. Sometimes, the pattern can result in a false breakout where the price fails to sustain above the neckline, reverting back to the downtrend.

- Subjectivity: The identification of the pattern can be subjective, with different traders interpreting the formation differently. The clarity of the pattern, the symmetry of the shoulders, and the definition of the neckline can vary, leading to potential misinterpretation.

- Volume Confirmation: The pattern is more reliable when accompanied by significant volume, especially during the breakout above the neckline. Lack of volume can indicate weak buying interest, reducing the pattern’s reliability.

- Market Conditions: External factors such as market sentiment, economic news, and geopolitical events can influence the effectiveness of the pattern. Traders should consider the broader market context when trading based on this pattern.

- Timeframe: The pattern’s reliability can vary across different timeframes. Patterns that form over longer periods tend to be more reliable than those observed on shorter timeframes, which may be more prone to noise and false signals.

- Confirmation: It is advisable to use the Inverted Head and Shoulders pattern in conjunction with other technical indicators and analysis methods for confirmation. Relying solely on this pattern can increase the risk of false signals.

Understanding these limitations and considerations is crucial for effectively incorporating the Inverted Head and Shoulders pattern into trading strategies. It emphasizes the need for a comprehensive approach to market analysis, combining pattern recognition with other analytical tools and market insights.

Conclusion

The Inverted Head and Shoulders pattern is a powerful tool in technical analysis, signaling potential bullish reversals after a downtrend. Its distinct formation—comprising two shallower troughs (the shoulders) and a deeper trough (the head), connected by a neckline—provides a visual representation of changing market sentiment from bearish to bullish. However, traders must be mindful of the pattern’s limitations and consider additional factors such as volume confirmation, market conditions, and other technical indicators for a more reliable analysis.

Understanding the psychological underpinnings of the pattern enhances its application, revealing the market’s transition from pessimism to optimism. Real-world examples underscore its practical value, offering insights into how it can be identified and leveraged for trading opportunities.

Yet, the effectiveness of the Inverted Head and Shoulders pattern is not absolute. Traders should approach it with caution, recognizing the potential for false signals and the impact of subjective interpretation. It’s most effective when integrated into a comprehensive trading strategy that includes risk management practices and considers broader market trends.

In conclusion, while the Inverted Head and Shoulders pattern is a significant indicator for identifying potential bullish reversals, its successful application depends on careful analysis, confirmation from additional indicators, and an awareness of its inherent limitations. Traders who master these aspects can use the pattern to enhance their trading decisions and capitalize on emerging bullish trends.

Disclaimer-

स्टॉक मार्केट (Stock Market )में निवेश करना विपरीत प्रतिभाशाली और जोखिमपूर्ण हो सकता है। कृपया ध्यानपूर्वक समझें कि आपके निवेश के परिणामस्वरूप होने वाले हर फैसले का आपका खुद का जिम्मेदार है और आपको अपने वित्तीय लक्ष्य, धन रिस्क, और अन्य पहलुओं को मध्यस्थ करने के लिए स्वयं जिम्मेदारी लेनी चाहिए।

किसी भी निवेश से पहले, कृपया वित्तीय सलाहकार से परामर्श प्राप्त करें और अपनी वित्तीय स्थिति, लक्ष्य, और आवश्यकताओं की जांच करें।

Also Check – IPO (आईपीओ) क्या है? IPO प्रक्रिया और निवेश के फायदे और खतरे